South Florida Real Estate Daily Brief – August 7, 2025

South Florida Real Estate Daily Brief – August 7, 2025

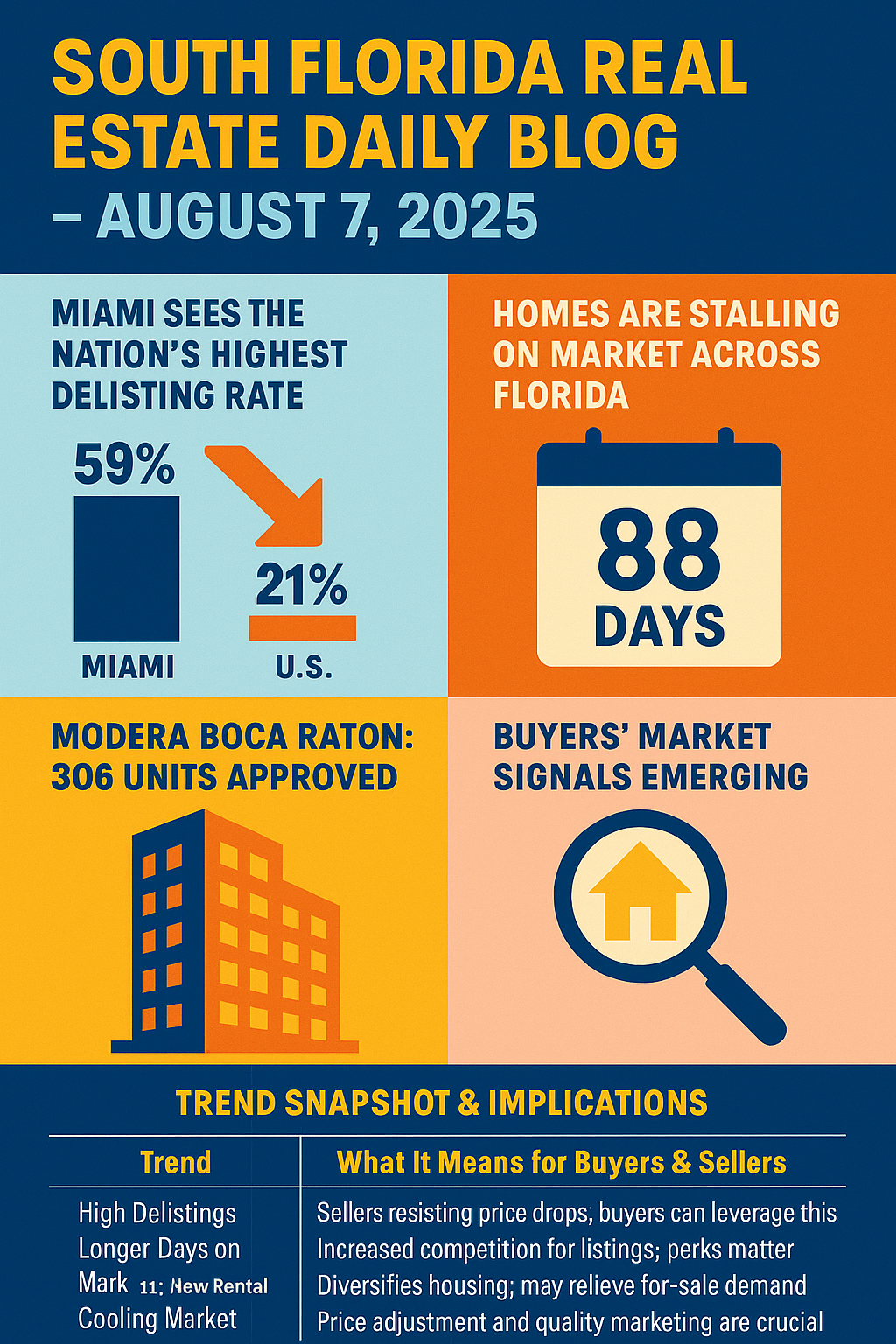

1. Miami Leads Nation in Home Delistings

Miami homeowners are removing their listings at the highest rate in the U.S.—a staggering 59% delisting-to-new-listing ratio, compared to the 21% national average. This comes amid a 4.7% drop in median listing prices, a 30% inventory jump, and a lengthy 88-day average time on market. Interestingly, only 18% of listings saw price cuts, suggesting many sellers hold out rather than negotiate.MIAMI REALTORS®+1Miami Herald+1New York Post

-

Implication: High supply combined with price resistance signals a softening market. Buyers may have more leverage—but limited flexibility remains key.

2. Migration Momentum Slows

A new report points to a notable shift: Florida residents are finding it harder to sell homes, hinting that the post-pandemic migration wave may be waning.Moneywise+1Yahoo+1

-

Implication: Demand-driven growth may plateau, leading to more stabilized—and potentially more balanced—market conditions.

3. Miami-Dade Home Sales Continue Sharp Decline

July data shows single-family home closings in Miami-Dade remain in a prolonged slump, with both single-family and condo sectors offering limited signs of recovery.CoStar+15Florida Politics+15New York Post+15

-

Implication: Market volume is down—making negotiation, financing readiness, and pricing accuracy more critical for buyers and sellers.

4. Mortgage Rates Dip, Buyers Get a Window

A national real estate outlook shows mortgage rates are beginning to fall, and housing price growth is cooling—offering a potential opening for serious buyers to lock in favorable terms.Redfin

-

Implication: Reduced financing costs alongside softening prices may create prime opportunities for motivated buyers.

5. Florida Home Prices Slide

In line with broader softening, Zillow reports year-over-year home price declines of 3.8% in Miami and nearly 6% in Tampa.instagram.com+8axios.com+8areaproflrealty.com+8

-

Implication: Regional pricing pressure may shift investment strategies—encouraging buyers to explore higher value in currently declining markets.

6. New Development: Modera Boca Approved

Boca Raton’s city officials greenlighted Modera Boca, a 302-unit multifamily development by Group P6 and Mill Creek Residential.South Florida Agent Magazine

-

Implication: More rental options are coming, which could ease pressure on the for-sale market and diversify housing offerings in the area.

7. Delays in Sales: Homes Stuck on Market

A report reveals homes across Florida’s major metros aren’t selling—not because of low inventory, but because existing listings are priced too high, causing slow turnover.Wolf Street

-

Implication: This mismatch underscores the importance of price realism—both for agents setting expectations and buyers seeking value.

Summary

Buyers may finally benefit from favorable conditions—falling mortgage rates, cooling prices, and fewer competing offers.

Sellers should consider adjusting price expectations and investing in marketing finesse, especially as delistings rise and closings slow.

Developers and Investors may want to monitor rental demand trends and new multi-family supply flows, like Modera Boca.

Agents and Brokers: Creative strategies—such as staged listings, photorealistic tours, or temporary rental-to-buy conversions—could help turn stubborn inventory into closed deals.

Categories

Recent Posts